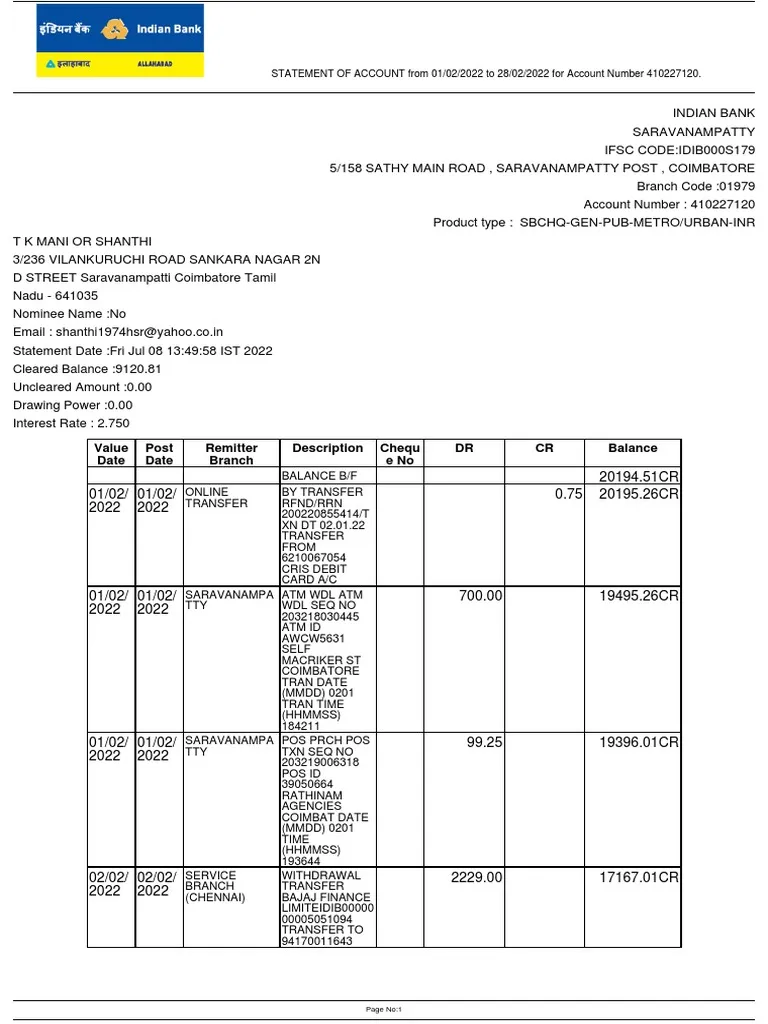

A bank statement is your official financial record—a detailed list of all transactions in your account over a defined period (usually a month). Think of it as your personal financial diary, showing deposits, withdrawals, fees, and balances, Indian Bank complete with dates, transaction descriptions, and reference numbers

Table of Contents

🏗️ Key Sections of an Indian Bank Statement

- Account Information

- Name, address, mobile number, account number and type.

- Statement Summary

- The period covered (e.g., April 1–30), opening and closing balances.

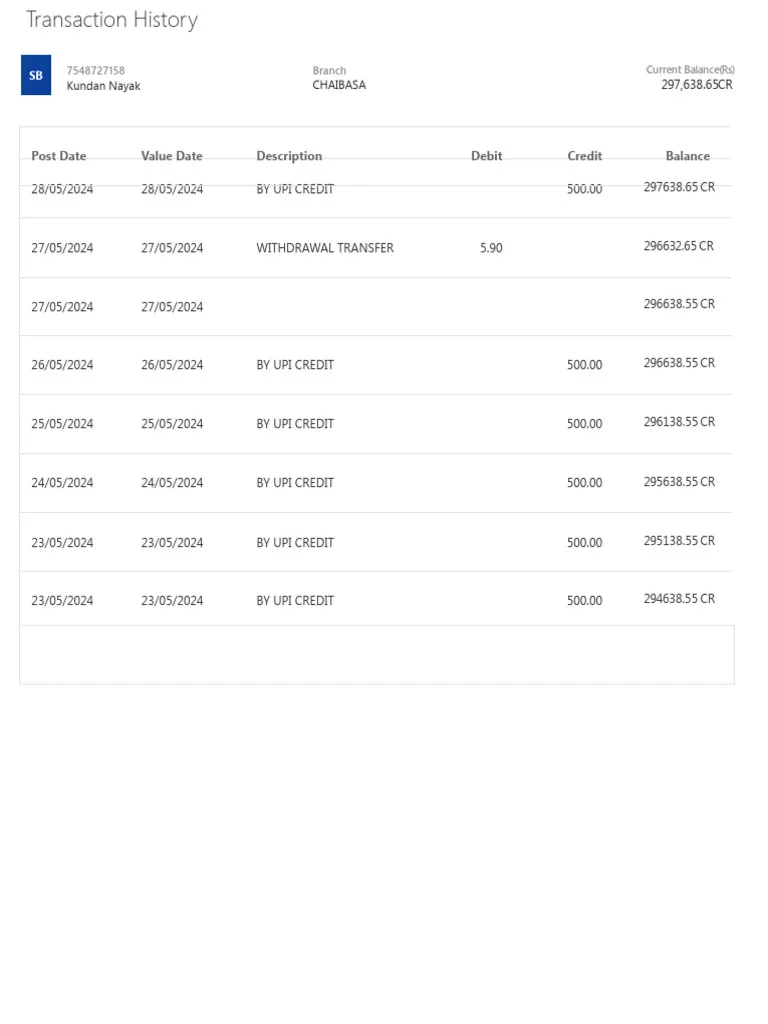

- Transaction History

- Every debit and credit, with date, description (e.g., NEFT transfer, ATM withdrawal, UPI payment), amount, and balance after each entry.

🔍 Why It Matters

- Money Management: Track inflows and outflows to plan budgets more effectively.

- Fraud Detection: Notice unauthorized charges early, including hidden fees or automatic debits .

- Tax & Loan Proof: Statements validate income and Indian Bank expense claims for tax filings or loan applications .

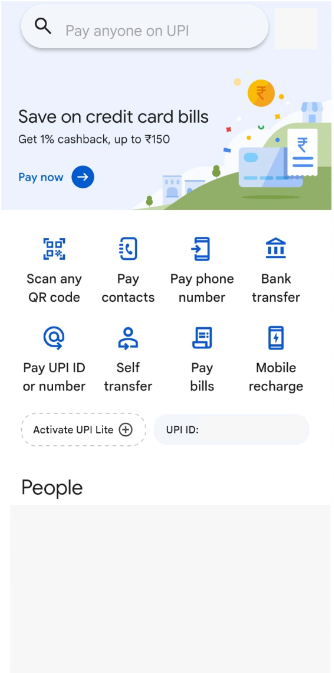

🚀 How to Access Your Statement

Online Methods

- Net Banking: Log in → My Accounts → Statement of Accounts → select duration → download as PDF or Excel .

- Mobile Banking App (IndOASIS/IndPay/IndSMART): Go to Passbook, Account Summary, or e‑Statements → choose your period → download or view .

- Email Statement: Register your email at a branch or via mobile app under Value‑Added Services → get PDF Indian Bank statements monthly/quarterly → secured with your account number as the password.

Offline Methods

- Branch Visit: Request printed or certified statements, often needed for official uses .

- ATM Mini‑Statement: Last 5–10 transactions available via ATM slip .

- Missed‑Call/SMS/WhatsApp/IVR:

- Missed call to 8108781085 or 1800 425 00000 → SMS with latest 3 transactions .

- SMS “LTRAN <PIN>” to 9444394443 → SMS with 3 txn .

- WhatsApp at 87544 24242 or IVR → mini‑statement readout .

🧠 Making Sense of It

- Opening & Closing Balances: Helps verify starting and ending positions.

- Credits: Salaries, refunds, interest—label with categories like SALARY, INTEREST, INCOME.

- Debits: Assign categories (Groceries, Utilities, Investments); watch auto-debits like EMIs or insurance.

- Fees & Charges: Look out for ATM fees, SMS charges, maintenance fees—they can hurt your balance .

- Recurring Transactions: Identify standing instructions Indian Bank to make sure no unauthorized money is moving out .

- Reconciling: Match your personal expense records or spreadsheet with the statement to catch discrepancies

⚙️ Tips for Smarter Analysis

- Use Excel/CSV: Export to Excel → add “Category” column → filter, pivot, chart. Much faster than pen & paper.

- Auto‑categorization Apps: Try Walnut, Fi, Jupiter, INDMoney—they pull SMS and auto‑sort expenses for you.

- Divide Accounts: Use separate accounts or UPI Indian Bank accounts for different types of spending (e.g., daily vs. bills)

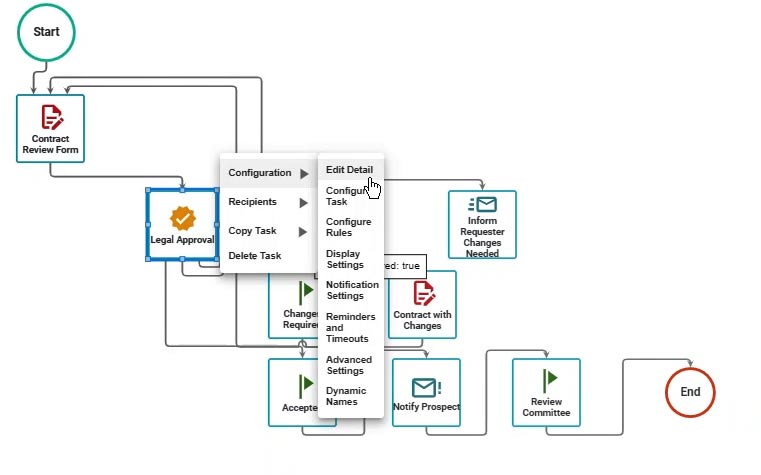

✅ Sample Workflow

- Download April’s statement in Excel.

- Add a “Category” column.

- Go through credits: tag items as SALARY, INTEREST, etc.

- Tag debits: GROCERIES, TRANSPORT, EMI, etc.

- Use Pivot Table to tally monthly spend per category.

- Visualize with charts—spend smarter!

💡 Why It’s Worth It

- Control & Clarity: Understand where your money goes and stop overspending.

- Fraud Alert: Spot unexpected charges quickly.

- Tax & Loans: Well-categorized statements simplify documentation for ITR or bank loans.

- Financial Discipline: Regular reviews build healthy financial habits.

🏁 Final Thoughts

Bank statements are more than numbers—they’re a window into your financial life. Indian Bank Use them to track your habits, protect your money, and plan ahead.