In India, several government schemes provide substantial financial assistance to individuals aged 18 and above. While the exact amount varies, some programs offer up to ₹25 lakh or more, aiming to support education, entrepreneurship, and social welfare. Here’s an overview of such schemes.

Table of Contents

🎓 1. PM CARES for Children Scheme

The PM CARES for Children Scheme is designed to support children who have lost both parents due to COVID-19. Under this scheme.

- ₹10 Lakh Corpus Fund: A corpus of ₹10 lakh is created for each beneficiary.

- Monthly Stipend: From the age of 18, beneficiaries receive a monthly stipend until they turn 23.

- Lump Sum Amount: On turning 23, the beneficiary receives ₹10 lakh.

This initiative ensures financial support for the education and welfare of orphaned children.

🏠 2. Scheme for Disabled Young Professionals

The Scheme for Disabled Young Professionals offers financial assistance to professionally educated unemployed disabled youth. Key features include:

- Maximum Loan Limit: Up to ₹25 lakh.

- Interest Rates: 5% p.a. for loans up to ₹50,000; 6% p.a. for loans above ₹50,000 and up to ₹5 lakh; 8% p.a. for loans above ₹5 lakh.

- Rebate: A 1% p.a. rebate on interest for disabled young women professionals.

This scheme aims to promote self-employment among disabled youth.

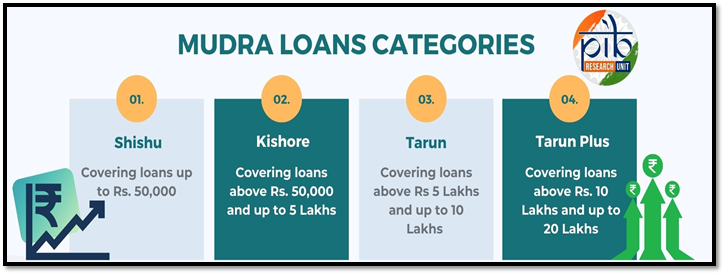

🏭 3. Mudra Yojana (Tarun Category)

Under the Mudra Yojana, the Tarun category provides financial support for business expansion:

- Loan Amount: Between ₹5 lakh and ₹10 lakh.

- Purpose: To support the growth and development of existing small businesses.

This scheme encourages entrepreneurship and the growth of micro-enterprises.

🎓 4. Educational Loan Schemes

Various educational loan schemes offer financial assistance for higher studies:

- Loan Amount: Up to ₹30 lakh for studies in India; up to ₹40 lakh for studies abroad.

- Interest Rates: 2% for men and 1.5% for women for loans up to ₹10 lakh; 3% for men and 2.5% for women for loans above ₹10 lakh.

- Repayment Period: Within 10 years for loans up to ₹10 lakh; within 12 years for loans above ₹10 lakh.

These loans facilitate access to quality education both in India and abroad.

🧑🎓 5. Pradhan Mantri Kaushal Vikas Yojana (PMKVY)

The PMKVY aims to enhance the employability of youth through skill development:

- Training Programs: Short-term training, recognition of prior learning, and special projects.

- Target Group: Individuals aged between 15 and 45 years.

- Financial Support: Monetary awards and rewards for successful completion of training.

This scheme empowers youth with industry-relevant skills.

🏠 6. Pradhan Mantri Awas Yojana (PMAY)

The PMAY aims to provide affordable housing to all:

- Loan Amount: Up to ₹6.5 lakh under the Credit Linked Subsidy Scheme.

- Interest Subsidy: Subsidy on interest rates for eligible beneficiaries.

- Target Group: Economically weaker sections, low-income groups, and middle-income groups.

This scheme ensures access to affordable housing for all.

🧭 Final Thoughts

While there isn’t a single government scheme that offers ₹25 lakh directly to individuals aged 18 and above, various programs provide substantial financial assistance across education, entrepreneurship, and social welfare. It’s essential to explore these schemes to identify the ones that best align with your needs and aspirations.

Understanding India’s Legal Metrology Laws:

APPLY