Table of Contents

In a world where financial stability is paramount, the Post Office Monthly Income Scheme (POMIS) stands out as a reliable and low-risk investment option for individuals seeking regular income. Offered by India Post, this scheme caters to conservative investors, retirees, and anyone looking to supplement their monthly earnings with guaranteed returns.

📌 What is POMIS?

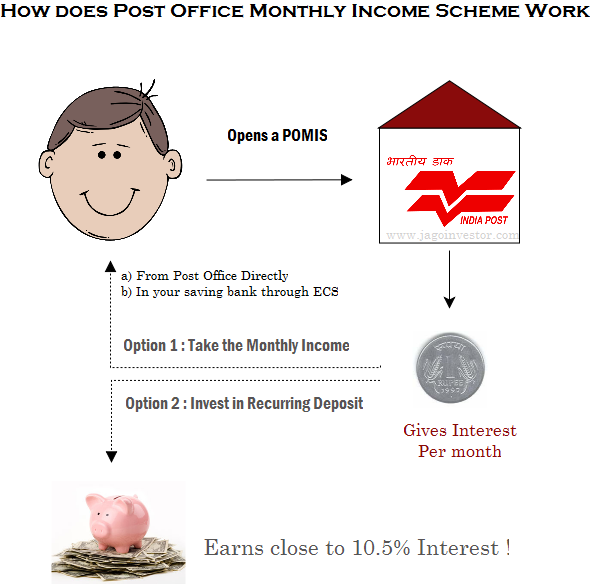

POMIS is a government-backed fixed-income investment plan that provides investors with a fixed monthly income over a 5-year tenure. It’s designed to offer capital protection while ensuring a steady cash flow, making it an attractive option for those averse to market volatility.

💰 Key Features of POMIS

Interest Rate

As of 2025, the scheme offers an interest rate of 6.60% per annum, payable monthly. This rate is subject to quarterly revisions by the government. While this rate may not outpace inflation, it remains competitive compared to other fixed-income instruments

Investment Limits

- Single Account: Up to ₹9 lakh

- Joint Account: Up to ₹15 lakh (for 2 or 3 adults)

- Minor Account: Up to ₹3 lakh

These limits are applicable across all post offices combined.

Minimum Investment

The scheme allows investments starting from ₹1,000, with subsequent deposits in multiples of ₹1,000. This affordability makes it accessible to a wide range of investors.

Tenure

The investment is locked in for a period of 5 years. Premature withdrawal is permitted, subject to certain conditions and penalties.

Taxation

Interest earned is taxable and subject to Tax Deducted at Source (TDS). However, the principal investment does not qualify for deductions under Section 80C

Nomination Facility

Investors can nominate a beneficiary to claim the proceeds in case of their demise. This ensures the safety and transferability of the investment.

Transferability

POMIS accounts can be transferred from one post office to another, facilitating ease of management in case of relocation

🧾 Eligibility Criteria

- Age: Any adult Indian citizen can open an account.

- Minor Accounts: Children above 10 years can have an account, with the guardian managing it until the child turns 18.

- Non-Resident Indians (NRIs): Not eligible to open or hold a POMIS account.

- Documentation: Aadhaar and PAN are mandatory for opening a new account. Existing account holders must link these within specified timelines to avoid account deactivation

💡 Advantages of POMIS

- Capital Safety: Being a government-backed scheme, it offers high security for the invested capital.

- Regular Income: Provides a fixed monthly income, aiding in budgeting and financial planning.

- Low Risk: Free from market fluctuations, making it ideal for risk-averse investors.

- Easy Management: Simple to open and manage through post offices across India

⚠️ Considerations Before Investing

- Interest Rate Fluctuations: The interest rate is subject to change, which may affect the monthly income.

- Tax Implications: Interest earned is taxable, which could impact the net returns.

- Premature Withdrawal Penalties: Exiting the scheme before maturity can lead to penalties, reducing the principal amount

📝 Conclusion

The Post Office Monthly Income Scheme is a prudent choice for individuals seeking a safe and predictable income stream. Its government backing, combined with regular payouts and low risk, makes it particularly appealing to retirees and conservative investors. However, it’s essential to consider the tax implications and the fixed nature of returns when planning your investment strategy.

For personalized advice and to explore whether POMIS aligns with your financial goals, consider consulting a financial advisor.

🎓 Reliance Foundation students Undergraduate Scholarships 2024–25: Empowering India’s Future Leaders