Table of Contents

India is brimming with government initiatives to empower youth. A key scheme is Uttar Pradesh’s Mukhyamantri Yuva Udyami Vikas Abhiyan (CM Yuva), which offers interest-free, collateral-free loans of up to ₹5 lakh to young entrepreneurs—including those who’ve only completed 10th grade.

💡 What Is the CM Yuva Scheme?

- Name: Mukhyamantri Yuva Udyami Vikas Abhiyan (also called CM Yuva)

- Purpose: To enable young UP residents to start small businesses

- Loan Amount: Up to ₹5 lakh, 100% interest-free for 4 years

- Collateral: No guarantee or security needed

- Subsidy: 10% margin-money grant on loan amount (varies by category)

- Eligibility:

- Age: ~21–40 years

- Education: At least 8th pass—10th pass preferred

- Skills: Basic or vocational training certificates (ITI, PMKVY, etc.)

- UP resident & no prior govt loan conflict

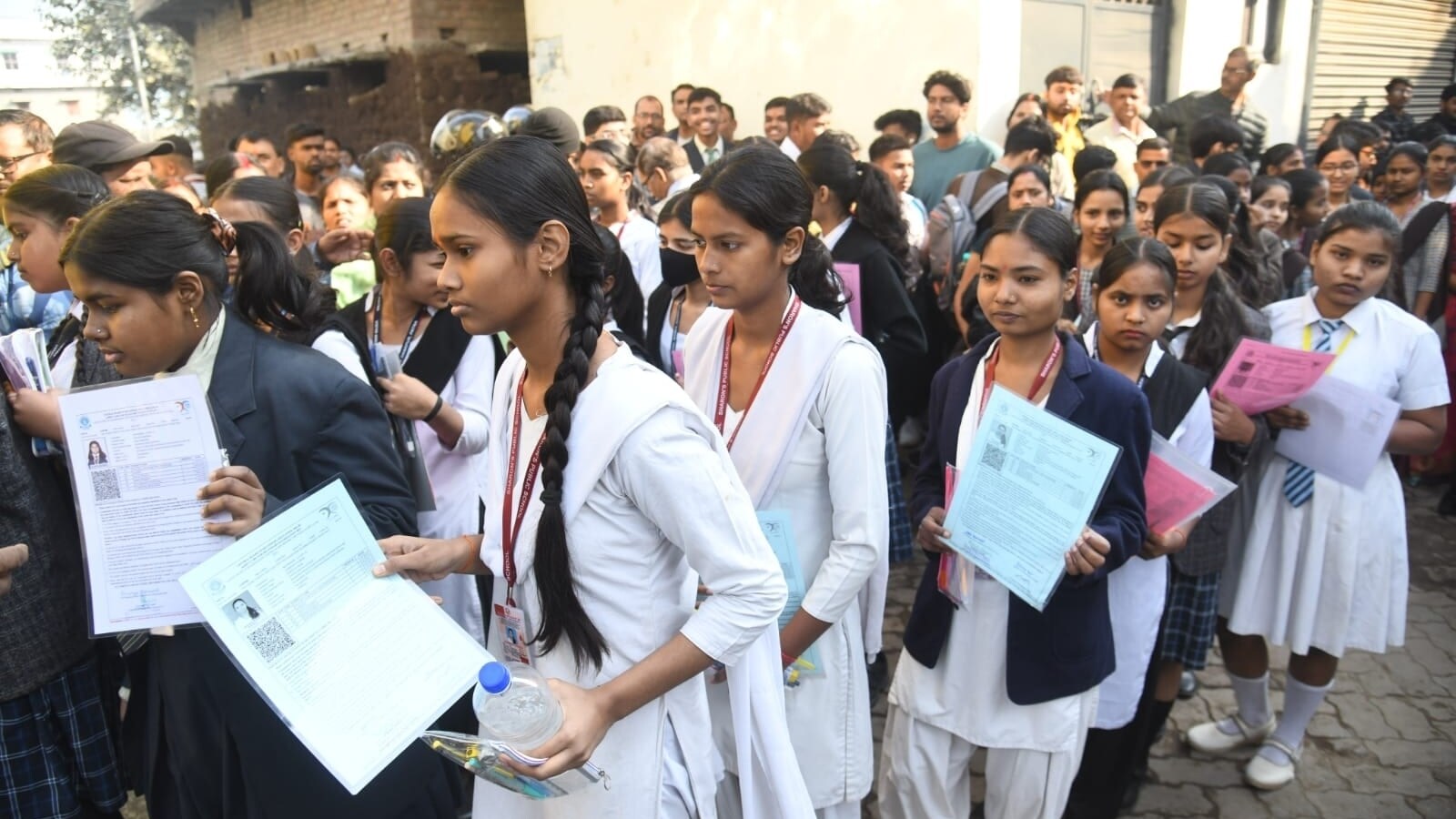

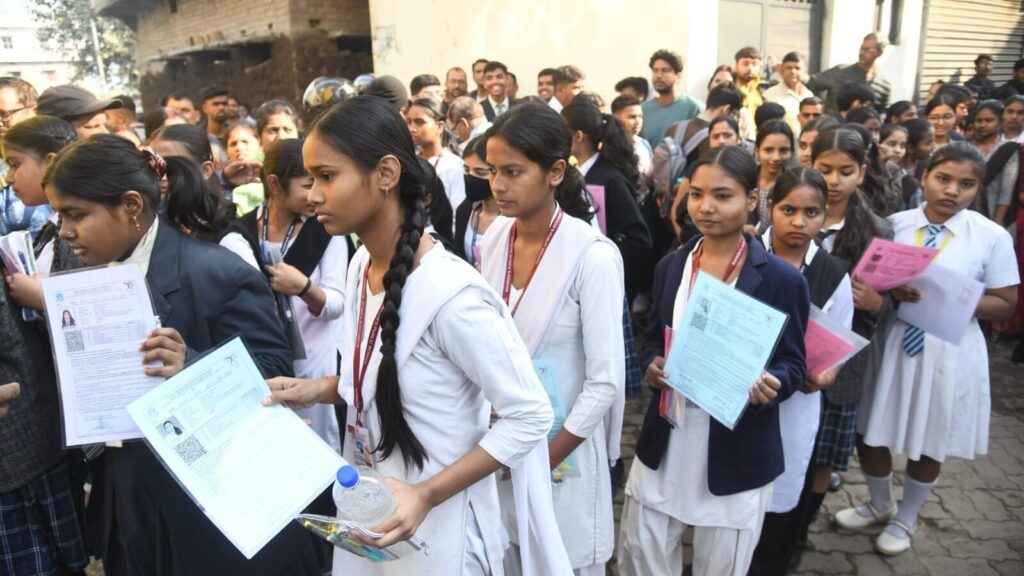

📈 Why This Matters for 10th-Pass Youth

This is not just an education loan—it’s a startup funding boost for young 10th-grade graduates:

- Zero interest + no collateral removes major barriers.

- Focused on self-employment, not just further study.

- Ideal for launching ventures like tutorials, tailoring, small-scale digital services, or dairying.

- Over 32,000 loans already approved and ₹5 lakh cheques given—like Garima Pandey’s library venture via Union Bank in Lucknow

🗂️ How the Scheme Works

Register online via UP MSME portal (e.g., msme.up.gov.in or cmyuva.iid.org.in)

- Submit documents: Aadhaar, education proof (10th pass), address, skill certificate, business plan.

- District selection: Committee reviews project feasibility.

- Loan sanctioning: Bank disburses the ₹5 lakh—no EMI for first 6 months

- Repayment & second-phase: After clearing first loan, you can apply for up to ₹10 lakh more—with interest subsidy.

🎯 Real-Life Successes

- Prabhnoor Kaur started a cake business with ₹4.25 lakh in Kanpur

- Yashwant, a tattoo studio in Lalitpur, funded with ₹5 lakh

- Aniket Singh, a laundry unit in Chitrakoot, turned ₹5 lakh into ₹30–35 k/month income

✔️ Step-by-Step: Your Path to ₹5 Lakh

| Step | What to Do |

|---|---|

| 1 | Pass Class 10 (or even 8th—but 10th preferred) |

| 2 | Get a skill/vocational certificate (e.g., PMKVY, ITI) |

| 3 | Draft a clear business plan (small shop, services, tailoring) |

| 4 | Register and apply on the CM Yuva portal |

| 5 | Prepare for a District Committee interview |

| 6 | Receive ₹5 lakh interest‑free loan |

| 7 | Start your venture, repay on time, and unlock next‑level funding |

⚠️ Also Worth Exploring

- PMMY (Mudra loans): India-wide loans up to ₹5 lakh under “Kishore” category for small businesses

- PM Vidyalakshmi: Educational loans up to ₹6.5 lakh for 10th/12th pass students meant for higher studies

- Skill programs like PMKVY, DDU-GKY or DAY ensure you earn training before launching.

🌟 Final Takeaway

Passing the 10th doesn’t just open classroom doors—it can unlock ₹5 lakh in startup capital, interest-free, to fuel your entrepreneurial dreams. Whether you want to start a shop, digital venture, or service business, UP’s CM Yuva scheme is a powerful launchpad—already transforming lives across the state